The Tax Cuts and Jobs Act of 2017 made several significant changes to the individual income tax, which will simplify the tax filing process for millions of households. These changes include reforms to family tax provisions, such as the near doubling of the standard deduction and child tax credit combined with the elimination of the personal exemption; they also include reforms to the alternative minimum tax and lower marginal tax rates across brackets.

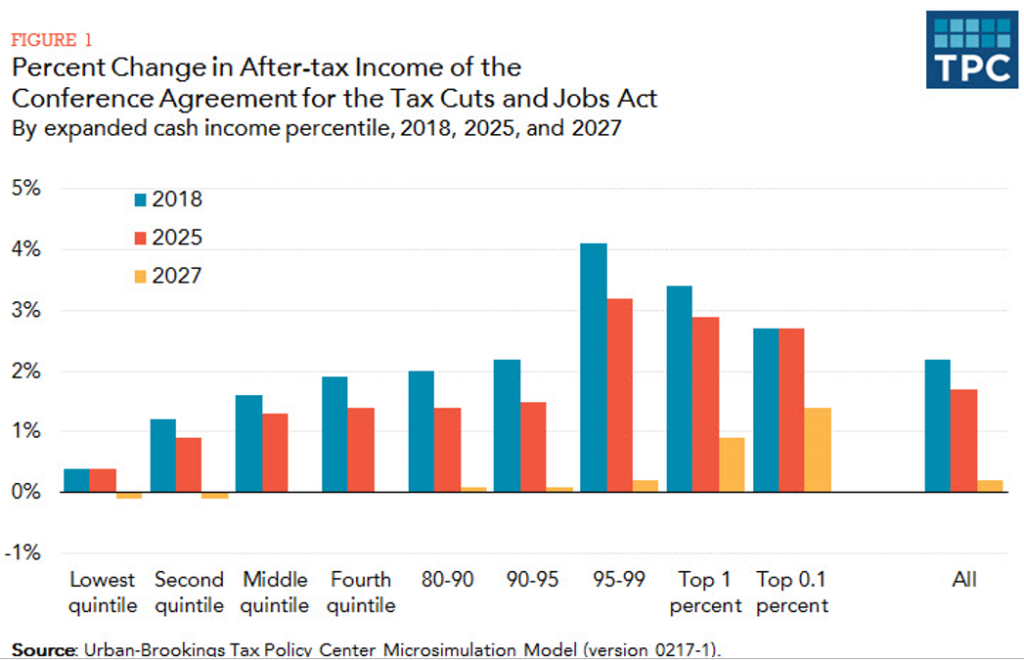

Obviously we all save if the tax code is simplified and filing taxes is easier and more straightforward. However, the tax cuts also increase the annual deficit, adding to the national debt that subsequent generations will be responsible for paying off. If you’ve wondered who benefits the most from these tax cuts, take a look at the following chart that shows that the average tax savings are about 2%, but for the top 5% of taxpayers, the percentage savings are much larger.