June 5, 2020

Executive Summary

The National Retiree Legislative Network (NRLN) fully supports competition from private healthcare plans and understands the financial challenges ahead for Medicare and the federal budget. However, we lobby against subsidies and legislated restrictions placed on original Medicare Fee-for-Service (FFS) just to preserve the notion that private insurance plans are inherently more effective.

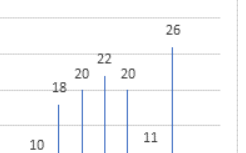

The NRLN’s primary concern has always been for its members and all seniors who see the Joe Namath TV ads about Medicare Advantage (MA) plans and good deals that are “FREE!” You can’t argue against facts. Congress has authorized MA insurers to pay for portions of deductibles, copays, and drug plans, vision, hearing, silver sneakers, etc. and out-of-pocket maximum protection. However, it is also a fact that all Medicare enrollees must pay $144.60 monthly for Medicare A & B benefit and it is a fact that every American who pays income taxes is paying for this list of so-called benefits. Congress pays MA insurers rebates of $122 a month per enrollee, $35 billion this year, paid directly to them to pay for their lists of extras. For perspective, a prescription drug plan including a deduction and co-pays might cost $50 a month of the $122. This whitepaper exposes three realities: 1) healthcare costs are rising four times faster than the number of new Medicare enrollees, 2) after 23 years and over $350 billion in rebates paid to MA plans, their annual payments per enrollee are higher than for enrollees in the original Medicare FFS plan, and 3) MA plan privatization has already failed; we believe public opinion and mounting costs will lead to pressure to end MA plan rebates. The Medicare Payment Advisory Committee (MedPAC) and the Medicare Trustees have projected that as MA plan enrollees age they will use even more healthcare products and services per capita and large MA plan increases in premiums, deductibles, co-pay and coinsurance costs are expected. The Congressional Budget Office (CBO) in its 2017 report to the House Budget Committee projected a minimum of 35% in premium increases by 2022. The NRLN wants to be sure that Congress demands that all the facts be on the table when those entering Medicare choose between FFS or one of the 4,000 private MA plans in 2020. It is critical that prospective enrollees fully understand that if an MA plan is chosen and 12 months elapse, that while they can switch to Medicare FFS, they must meet pre-existing conditions and other underwriting requirements to qualify for Medigap supplemental coverage. Those who do qualify with restrictions may have to pay excessive premiums. AREF American Retirees Education Foundation 2 The 2020 Medicare Trustees report projects the number of Medicare enrollees to grow by 25% from 2009 – 2029. Healthcare payments grow by 101%, 4 times faster than the number of enrollees who use the benefits. It is evident that healthcare costs are out of control! By 2029 costs per enrollee will rise 60% from 2019, consequently, costs per month grow by $600! Cost must be reduced, not just shifted to those over age-65. We must ensure that Medicare is there for our children, grandchildren and great grandchildren. This whitepaper includes NRLN’s 1997-2020, 23-year roadmap of when and how Congress approved the use of taxpayer dollars to pay bonus and rebate payments to MA plan insurers. MA market share of the Medicare market has grown mostly due to the awarding of quality bonuses and rebates that are used to fund and market new benefits. While Congress legislated quality bonuses and rebates that heavily favor MA plans in competition with FFS, it tipped the scales even more by enacting restrictive legislation that prohibits FFS from establishing provider networks or implementing new innovations and seeking competitive supplier bids for healthcare products or services. For example, FFS can’t accept competitive bids for prescription drugs or replacement seat cushions for wheelchairs. Congress passed legislation mandating that 19 new supplemental benefits be offered to MA plan enrollees only – to be paid for with more rebate money. The 44 million enrollees in original Medicare FFS have been denied access to these new benefits, however all MA plan enrollees are eligible. The NRLN asserts that this denial of benefits is discriminatory and breaks President Trump’s promise not to cut Medicare benefits. Two facts speak so loudly that seniors and taxpayers alike should immediately learn the intent of this MA privatization policy: 1) the acronym QBP does not mean Statistical Quality Control (SQC) as the rest of the world might recognize a quality program – QBP is named the Quality BONUS Program, a system to payoff insurers; and 2) the QBP boasts that its 5-star rating program is a valid aid for seniors to use in selecting plans and it could be, however one fact destroys this myth – a 1-star quality rated MA plan earns a 50% rebate payment! MedPAC warned Congress in 2018, 2019, and 2020 that QBP MA quality standards are mythical and unprofessionally derived and administered. The Health and Human Services (HHS) Inspector General has disapproved these payments, calling them Wrong or Improper Payments. This QBP program is a house of cards and the achilleas heel of privatization!! We conclude that current MA plan enrollees must be protected from loss of coverage and cost shifting and that the QBP must be professionalized to protect seniors. It must be validated by Quality Control industry experts and be stripped of the ability to award financial bonuses and rebates for simply delivering quality promised in bids. Four million enrollees in company or union MA–PPO plans are not as affected by rebates as MA–PPO plans. PPO plan benefits are usually not network restricted and premiums are negotiated and less dependent on rebates. More expensive PPO-like benefits can be negotiated and purchased through private insurance companies and are widely accessible. Congress is more focused on shifting healthcare costs to seniors rather than reducing costs. 3 NRLN Proposals • Immediately suspend MA plan bonus and rebate awards and order MedPAC, the Government Accountability Office (GAO), Congressional Budget Office (CBO) and the Health and Human Services (HHS) Inspector General to investigate and report on MA and original Medicare Part A and Part B independent financials and assess and publicly disclose the quality and cost effectiveness of MA, with and without taxpayer financial subsidies (rebates and star bonuses). • Grandfather and protect the 26 million seniors (36%), who have purchased MA plans in good faith, from future reductions in benefits and guarantee the protection of baked in subsidies as of December 31, 2019 and all future MA subsidies, rebates, rewards, bonuses and non-traditional Medicare plan benefits combined. • Make original Medicare A & B FFS enrollees, who have the same health conditions and needs as those in MA plans, eligible to receive all “new” benefits offered to MA plan enrollees, or retract the 2019 and 2020 “chronic” disease benefits e.g. home air filters and carpet shampooing for asthma patients, payments for heart healthy meals for those with heart disease and other services that represent a shift from services that prevented, improved or cured a patient’s conditions, to services determined by what a chronically ill patient needs. As it is, Congress has legislated highly discriminatory benefit access rights that picks winners and losers in the same universe or class. • Reduce the $140 billion annual wrong and improper payments generated by all federal agencies (particularly the $85 billion attributable to Medicare and Medicaid). Sequester savings and use them to eliminate the 75-year deficits of Medicare Part A and Part B, • Centers for Medicare and Medicaid (CMS) and Congressional Operational Priorities: CMS must focus resources on refining FFS Benchmark fees and costs based on county and / or regional market costs for goods and services by focusing on a prioritized list of treatments for life threatening and/or high cost end results criteria. Rename QBP to Healthcare Statistical Quality Control (HSQC) plan (or anything but QBP) and establish measurable supplier process and end results standards, audit and report on supplier performance results. Motivate Affordable Care Organizations (ACOs)-like supplier delivery and wellness systems and create a focused FFS cost reduction plan. Congress has a duty to amend or create legislation that enables Medicare FFS free-market authority to seek competitive bids and buy healthcare products and services directly without artificial constraints or obligations to buy through middlemen. Also, current legislation that prohibits Medicare FFS from innovating with new programs or to form networks that would lower healthcare costs and better serve seniors’ healthcare needs must be abolished. Congress has afforded MA plans an unfair competitive advantage – it must eliminate this preferential treatment!